Tax and its Importance | Term 3 Unit 1 | Economics | 7th Social Science - Exercises Questions with Answers | 7th Social Science : Economics : Term 3 Unit 1 : Tax and its Importance

Chapter: 7th Social Science : Economics : Term 3 Unit 1 : Tax and its Importance

Exercises Questions with Answers

Evaluation

I. Choose

the correct answer:

1. Taxes

are________________ payment.

a.

Voluntary

b.

Compulsory

c.

a & b

d.

None of the above

[Answer: (b)

Compulsory]

2. Minimum possible

amount should be spent in the collection of taxes is

a.

canon of equality

b.

canon of certainity

c.

canon of economy

d.

canon of convenience

[Answer: (c) canon

of economy]

3. This taxation is a

very opposite of progressive taxation.

a.

Degressive

b.

proportional

c.

regressive

d.

none

[Answer: (c) regressive]

4. Income tax is a

a.

direct tax b.

b.

indirect tax

c.

a & b

d.

degressive tax

[Answer: (a) direct

tax]

5. Which tax is raised

on provision of service.

a.

Wealth

b.

corporate

c.

wealth

d.

service

[Answer: (d)

service]

II. Fill

in the blanks:

1.

Taxation

is a term for when a taxing authority usually a government levies or imposes a

tax.

2.

Proportional

Taxation is the method, where the rate of tax is

same regardless size of the income.

3.

Gift tax

is paid to the Government by the recipient of gift depending on value of gift.

4.

Direct

tax burden cannot be shifted by tax payers.

5.

Indirect tax is more elastic

III. Match

the following:

1.

Principle of taxation – Direct Tax

2.

Estate tax – Goods and Service Tax

3.

Excise Tax – Adam Smith

4.

01.07.2017 – Less elastic

5.

Direct Tax – Indirect Tax

Answer:

1. Principle of

taxation - Adam Smith

2. Estate tax - Direct Tax

3. Excise Tax - Indirect Tax

4. 01.07.2017 - Goods and Service Tax

5. Direct Tax - Less elastic

IV. Odd

one out:

1.

Which one of the following is not a indirect tax?

2.

a) Service tax b) Value Added Tax (VAT) c) Estate duty d) Excise duty

[Answer: (c) Estate

duty]

V. Correct

one out :

1.

Which one of the following tax is a direct tax?

a.

Service tax

b.

Wealth tax

c.

Sales tax

d.

Progressive tax

[Answer: (b) Wealth

tax]

VI. Give

short answer:

1. Define tax.

Answer: Taxes are defined as a compulsory contribution from a person to

the government to defray the expenses incurred in the common interest of all

without reference to special benefits conferred.

2. Why taxes are

imposed?.

Answer: Everybody is obliged by law to pay taxes. Total Tax money goes

to government exchequer. Appointed government decides that how are taxes being

spent and how the budget is organized.

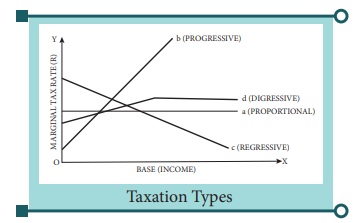

3. Write name of

taxation types and draw its diagram.

Answer: Taxation

Types:

There are four types of Taxation:

(i) Proportional Tax

(ii) Progressive Tax

(iii) Regressive Tax and

(iv) Degressive Tax

4. Write any three

importance of tax.

Answer:

(i) Health

(ii) Education

(iii) Governance

5. What are the types

of tax? and explain its.

Answer:

In modern times taxes are classified into two types. There are:

(i) Direct Tax:

A Direct tax is the tax whose burden is directly borne by the

person on whom it is imposed, (i.e), its burden cannot be shifted to others.

(ii) Indirect Tax:

When liability to pay a tax is on one person and the burden of

that tax shifts on some other person, this type of tax is called an indirect

tax.

6. Write short note on

Gift Tax and Service Tax.

Answer:

Gift Tax:

Gift tax is paid to the Government by the recipient of gift

depending on value of gift.

Service Tax:

Service tax is raised on provision of Service. This tax is

collected from the service recipients and paid to the Central Government.

7. What is Goods and

Service Tax?.

Answer:

(i) Goods and Services Tax is a kinds of tax imposed on sale,

manufacturing and usage of goods and services.

(ii) This tax is applied on services and goods at a national level

with a purpose of achieving overall economic growth.

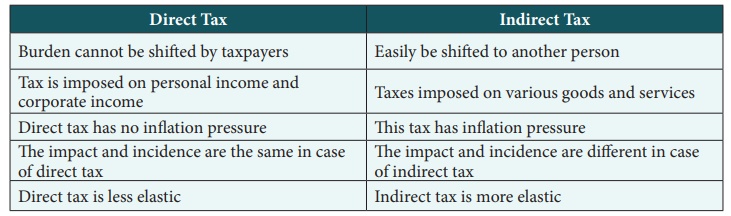

8. Distinguish between

the direct and indirect tax.

Answer:

Direct Tax

1. Burden cannot be shifted by taxpayers

2. Tax is imposed on personal income and corporate income.

3. Direct tax has no inflation pressure

4. The impact and incidence are the same in case of direct tax

5. Direct tax is less elastic

Indirect Tax

1. Easily be shifted to another person

2. Taxes imposed on various goods and services

3. This tax has inflation pressure

4. The impact and incidence are different in case of indirect

tax

5. Indirect tax is more elastic

VII. Give

brief answer:

1. Write briefly about

the principles of taxation.

Answer: (i) Canon

of Equality: The government should impose taxes

in such a way that people have to pay according to their ability does not mean

equal amount of tax but it means that the burden of a tax must be fair and

just.

(ii) Canon of

Certainity: Certainty creates confidence in the

taxpayers cost of collection of taxes and increases economic welfare because it

tends to avoid all economic waste.

(iii) Canon of

Convenience: Taxes should be levied and

collected in such a manner that provides a maximum of convenience to the

taxpayers should always keep in view that the taxpayers suffer the least

inconvenience in payment of the tax.

(iv) Canon of

Economy: Minimum possible money should be spent in the

collection of taxes. Collected amount should be deposited in the Government

treasury.

2. Explain the taxation

types.

Answer: Taxation

Types:

There are four types of Taxation:

(i) Proportional Tax

(ii) Progressive Tax

(iii) Regressive Tax and

(iv) Degressive Tax

(i) Proportional

Taxation is a method, where the rate of tax is same

regardless size of the income. The tax amount realized will vary in the same

proportion as that of income. If tax rate is 5% on income, Mr. X getting an

income of Rs.1000 will pay. Rs.50, Mr. B will be getting an income Rs.5,000

will pay tax of Rs.50. In short, proportional tax leaves the relative financial

status of taxed persons unchanged.

(ii) Progressive

Taxation is a method by which the rate of tax will also

increase with the increase of income of the person a case of progressive taxation

if a person with Rs.1000 income per annum pay a tax of 10% (i.e) Rs.100, a

person with an income of Rs. 10,000 per annum pays a tax of 25% (i.e) Rs.2,500

and a person with income of 1 lakh per annum pay the tax of 50% that is

Rs.50,000.

(iii) Regressive

taxation: It implies that hire the rate of tax furrow

income groups than in the case of higher income groups it is a very opposite to

progressive taxation.

(iv) Digressive

Taxes which are to mildly progressive, hence not very

steep, so that high income earners do not make a due sacrifice on the basis of

equity, are called digressive. In digressive taxation, a tax may be progressive

up to a certain limit; after that it may be charged at a flat rate.

3. Explain the

importance of tax.

Answer: Importance

of Tax:

Taxes are crucial because governments collect this money and use

it to finance under the following social projects.

1. Health:

(i) Without taxes, government contributions to the health sector

would be impossible.

(ii) Taxes go to funding health services such as social healthcare,

medical research, social security, etc.

2. Education:

(i) Education could be one of the most deserving recipients of tax

money.

(ii) Governments put a lot of importance in the development of human

capital and education is central in this development.

3. Governance :

(i) Governance is a crucial component in the smooth running of

country affairs.

(ii) Poor governance would have far reaching ramifications on the

entire country with a heavy toll on its economic growth.

(iii) Good governance ensures that the money collected is utilized in

a manner that benefits citizens of the country.

4. Other important

sectors are infrastructure development, transport, housing, etc.

(i) Apart from social projects, governments also use money collected

from taxes to fund sectors that are crucial for the wellbeing of their citizens

such as security, scientific research, environmental protection, etc.

(ii) Some of the money is also channeled to fund projects such as

pensions, unemployment benefits, childcare, etc.

4. Explain the direct

and indirect tax with examples.

Answer: Direct Tax:

(i) A Direct tax is the tax whose burden is directly borne by the

person on whom it is imposed, i.e., its burden cannot be shifted to others.

(ii) It is deducted at source from the income of a person who is

taxed.

(iii) Income tax is a direct tax because the person, whose income is

taxed, is liable to pay the tax directly to the Government and bear the burden

of the tax himself. Eg. Corporation tax, wealth tax gift tax estate dirty.

Indirect Tax:

(i) On the other hand when liability to pay a tax is on one person

and the burden of that tax shifts on some other person, this type of tax is

called an indirect tax.

(ii) Indirect Tax is a tax whose burden can be shifted to others.

(iii) For example: Service tax, Sales tax, Excise duty, Entertainment

tax.

5. Why need for tax on

people welfare? And explain it.

Answer: (i) The levying of taxes aims to raise revenue to fund governing or

to alter prices in order to affect demand.

(ii) Some of these include expenditures on economic infrastructure

like, transportation, sanitation, public safety, education, health-care

systems, etc., military, scientific research, culture and the arts, public

works, public insurance, etc. and the operation of government itself.

(iii) When expenditures exceed tax revenue, a government accumulates

debt. A portion of taxes may be used to service past debts.

(iv) Governments also use taxes to fund welfare and public services.

These services can include education systems, pensions for the elderly,

unemployment benefits, and public transportation.

(v) Energy, water and waste management systems are also common

public utilities.

(vi) The purpose of taxation is to maintain the stability of the

currency, express public policy regarding the distribution of wealth,

subsidizing certain industries or population groups or isolating the costs of

certain benefits, such as highways or social security.

(iii) Canon of

Convenience: Taxes should be levied and

collected in such a manner that provides a maximum of convenience to the

taxpayers should always keep in view that the taxpayers suffer the least

inconvenience in payment of the tax.

(iv) Canon of

Economy: Minimum possible money should be spent in the

collection of taxes. Collected amount should be deposited in the Government

treasury.

VIII. Activity

and Project

1. Students are asked

to go to the nearest departmental store and know about the Goods and Service

tax (GST). Teacher and students are discussed about the GST.

2. Teacher asks the

student to write an essay on what is tax? why we pay tax? And how does the

Government use this tax for the welfare of the people.

IX. Life

Skills :

1. Teacher and Students

together discuss about the tax and their importance of development of country.

Related Topics