Questions with Answers, Solution | Life Mathematics | Chapter 4 | 8th Maths - Exercise 4.2 (Profit, Loss, Discount, Expenses and GST) | 8th Maths : Chapter 4 : Life Mathematics

Chapter: 8th Maths : Chapter 4 : Life Mathematics

Exercise 4.2 (Profit, Loss, Discount, Expenses and GST)

Exercise

4.2

1. Fill in the blanks:

(i) Loss

or gain percentage is always calculated on the__________. [Answer: Cost price]

(ii) A mobile phone is sold for ₹8400

at a gain of 20%. The cost price of the mobile phone is________. [Answer: ₹ 7000]

Solution:

Let cost price of mobile be ₹ x

Given that selling price is ₹ 8400 and gain is 20%

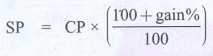

As per formula,

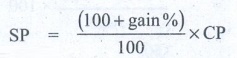

SP = [ (100 + gain %) / 100 ] × CP

∴ by substituting we get,

8400 = [ (100 + 20) / 100 ] × x

8400 = [120 / 100] x

x = [8400 × 100] / 120 = ₹

7000

(iii) An article is sold for ₹555 at

a loss of 7 1/2 %. The cost price of the article is ________. [Answer: ₹ 600 ]

Solution:

Given selling price is

₹ 555 & loss is 7 1/2%

as per formula,

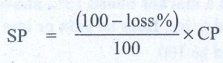

SP = [ (100−loss %) / 100 ] × CP

by substituting, we get

555 = [ (100 – 7 1/2) / 100 ] × CP

∴ 555 = [ (100 – 15/2) /100 ] × CP = [ ( (200 – 15)/2) / 100 ] × CP

555 = [ (185/2) / 100 ] × CP

∴ CP = (555 × 100) / (185/2)

= [ (555 × 100) / 185 ] × 2 = ₹ 600

(iv) A mixer grinder marked at ₹4500

is sold for ₹4140 after discount. The rate of discount is __________. [Answer: 8%]

Solution:

Marked price is ₹ 4500

Discounted price in ₹ 4140

∴ Discount = Marked price − Discounted price

= 4500 − 4140 = 360

∴ Rate of discount = [ Discount

/ Marked Price ] × 100

= [360 / 4500] × 100 = 8%

(v) The total bill amount of a shirt

costing ₹575 and a T-shirt costing ₹325 with GST of 5% is_______. [Answer: ₹ 945]

Solution:

Cost price of shirt = ₹ 575 (CP)

GST = 5%

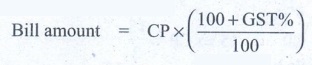

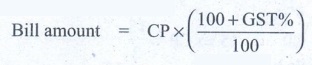

Bill amount formula = CP × [ (100 + GST%) / 100]

= 575 × [(100 + 5) / 100] = 575 × [105 / 100] = ₹ 603.75

Cost price of T−shirt = ₹ 325 (CP)

GST = 5%

Bill amount = CP × [ (100 + GST%) / 100]

= 325 × [ (100 + 5) / 100 ] =

₹ 341.25

∴ Total bill amount = ₹ 603.75 + ₹ 341.25 = ₹ 945

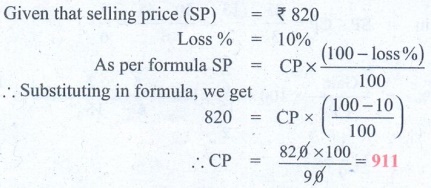

2. If selling an article for ₹820 causes

10% loss on the selling price, then find its cost price.

Solution 1:

Solution 2:

Given that selling price (SP) = ₹ 820

Loss % = 10%

As per formula SP = CP × [ (100 – loss%) / 100 ]

∴ Substituting in formula, we get

820 = CP × [ (100 – 10) / 100]

∴ CP = [ 820 × 100 ] / 90 = 911

3. If the profit earned on selling an

article for ₹810 is the same as loss on selling it for ₹530, then find the cost

price of the article.

Solution:

Case 1: Profit = Selling price (SP) − Cost price (CP)

Case 2: Loss = Cost price (CP) − Selling price (SP)

Given that profit of case 1 = loss of case 2

∴ P = 810 − CP

L = CP − 530

Since profit (P) = loss (L)

810 − CP = CP − 530

∴ 2CP = 810 + 530 =

1340 ⇒ C.P = 1340/2

∴ CP = 670

4. If the selling price of 10 rulers

is the same as the cost price of 15 rulers, then find the profit percentage.

Solution:

Let cost price of one ruler be x

Given that selling price (SP) of 10 rulers,

i.e., same as cost price (CP) of 15 rulers

∴ SP of 10 rulers =

15 × x = 15x

∴ SP of 1 ruler = 15x / 10 = 1.5x

∴ Gain = SP of 1 ruler − CP of 1 ruler = 1.5x − x =

0.5x

Gain % = [ Gain / CP ] × 100 = [ 0.5x / x ] × 100

= 50%

5. Some articles are bought at 2 for

₹15 and sold at 3 for ₹25. Find the gain percentage.

Solution:

Let cost price of one article be C.P

Given that 2 are bought for

₹ 15

∴ 2 × CP = 15 ⇒ CP= 15/2

Let selling price of one article be SP

Given that 3 are sold for ₹ 25

∴ 3 × SP = 25 ⇒ SP = 25/3

∴ Gain = SP – CP = 25/3 – 15/2 = [50 – 45] / 6 = 5/6

Gain % = [Gain / CP] × 100 = [ (5/6) / (15/2) ] × 100 = [ 5/6 ×

2/15 ] × 100 = 100/9

= 11 1/9 %

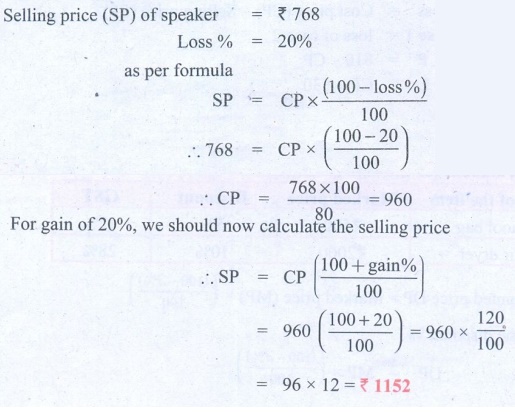

6. By selling a speaker for ₹768, a man

loses 20%. In order to gain 20%, how much should he sell the speaker?

Solution 1:

Solution 2:

Selling price (SP) of speaker = ₹ 768

Loss % = 20%

as per formula

SP = CP × [ (100 − loss %) / 100 ]

∴ 768 = CP × [ (100 – 20) /100 ]

∴ CP = [ 768 × 100 ] / 80 = 960

For gain of 20%, we should now calculate the selling price

∴ SP = CP [ (100 + gain%) / 100]

= 960 [ (100 + 20) /100 ] = 960 × (120 / 100)

= 96 × 12 = ₹ 1152

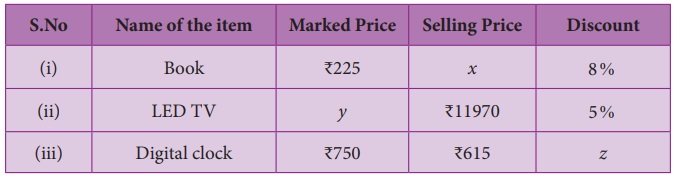

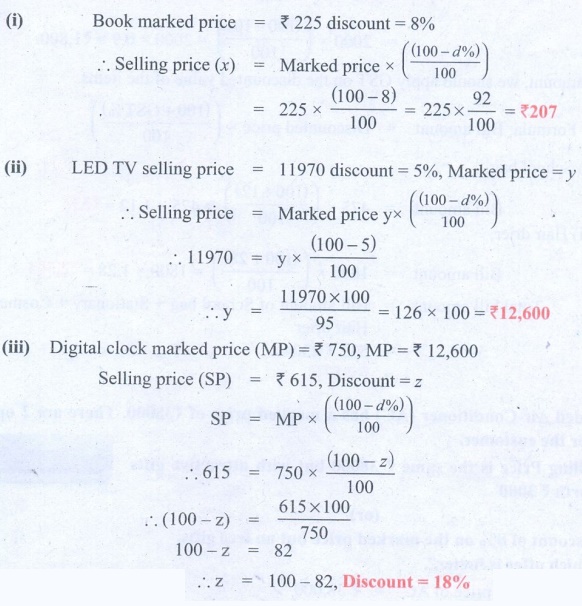

7. Find the unknowns x, y

and z.

Solution 1:

Solution 2:

(i) Book marked price = ₹225 discount =

8%

∴ Selling price (x)

= Marked price × [ (100 – d%) / 100 ]

= 225 × [ (100 – 8) / 100] = 225 × [92 / 100] = ₹ 207

(ii) LED TV selling price = 11970 discount

= 5%, Marked price = y

∴ Selling price = Marked price y × [(100 – d%) / 100]

∴ 11970 = y × [ (100 – 5) / 100 ]

∴ y = [11970 × 100] / 95 = 126 × 100 = ₹ 12,600

(iii) Digital clock marked price (MP) = ₹

750, MP = ₹ 12,600

Selling price (SP) = ₹ 615, Discount = z

SP = MP × [ (100 – d%) / 100 ]

∴ 615 = 750 × [ (100 – z) / 100 ]

∴ (100 − z) = [615

× 100] / 750

∴ 100 – z = 82

∴ z = 100 − 82, Discount

= 18%

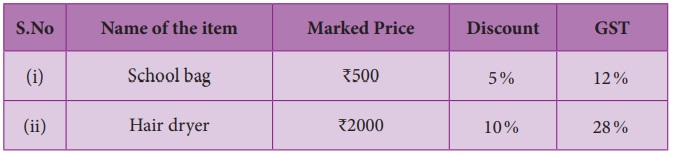

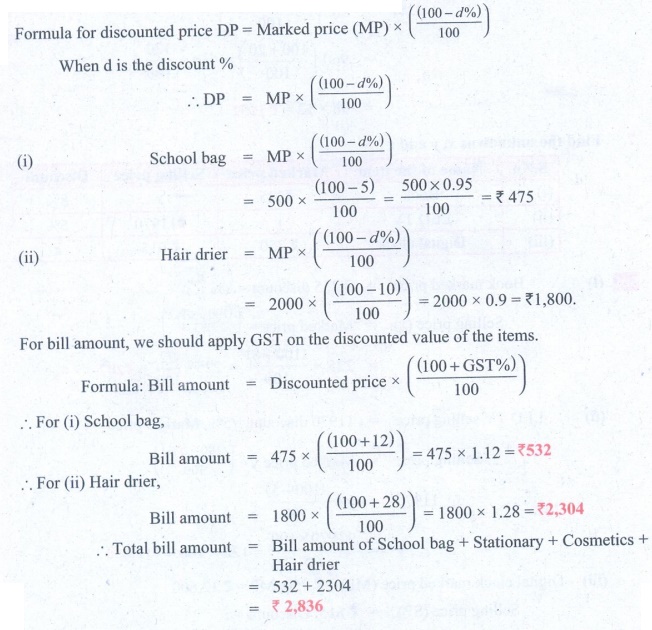

8. Find the total bill amount for the

data given below:

Solution 1:

Solution 2:

Formula for discounted price DP = Marked price (MP) × [ (100 – d%) / 100 ]

When d is the discount %

∴ DP = MP × [(100 – d%) / 100]

(i) School bag = MP × [(100 – d%) / 100]

= 500 × [ (100 – 5) / 100 ] = [500 × 0.95] / 100 = ₹ 475

(ii) Hair drier = MP × [ (100 – d%) / 100 ]

= 2000 × [(100 – 10) / 100] = 2000 × 0.9 = ₹ 1,800

For bill amount, we should apply GST on the discounted value of

the items.

Formula: Bill amount = Discounted price × [ (l00 + GST%) / 100 ]

∴ For (i) School bag,

Bill amount = 475 × [ (100

+ 12) / 100 ] = 475 × 1.12 = ₹ 532

∴ For (ii) Hair

drier,

Bill amount = 1800 × [ (100 + 28) / 100 ] = 1800 × 1.28 = ₹

2,304

∴ Total bill amount =

Bill amount of School bag + Stationary + Cosmetics + Hair drier

= 532 + 2304

= ₹ 2,836

9. A branded Air-Conditioner (AC) has

a marked price of ₹38000. There are 2 options given for the customer.

(i) Selling Price is the same ₹38000

but with attractive gifts worth ₹3000

(or)

(ii) Discount of 8% on the marked price

but no free gifts. Which offer is better?

Solution:

Marked price of AC = ₹ 38,000

Option 1:

Selling price = ₹ 38000 & gifts worth ₹ 3000

Net gain for customer = ₹ 3000 as there is no discount on AC

Option 2:

Discount of 8%, but no gift

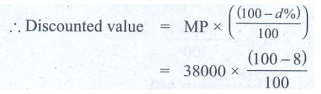

∴ Discounted value = MP × [ (l00 − d%) / 100 ]

= 38000 × [ (100 – 8) / 100 ] = 38000 × 0.92 = 34960

Savings for customer = 38000 – 34960 = ₹ 3040

Therefore, the customer gets 3000 gift in option 1 where as he

is able to save only ₹ 3040 in option 2. Therefore, option 2 is better.

10. If a mattress is marked for ₹7500

and is available at two successive discounts of 10% and 20%, find the amount to

be paid by the customer.

Solution:

Solution 2:

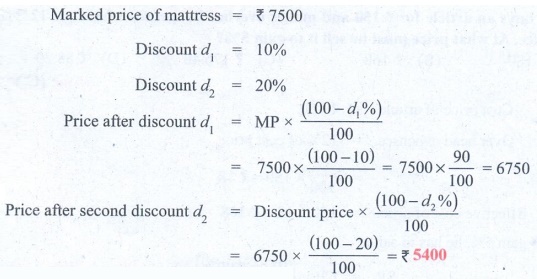

Marked price of mattress = ₹

7500

Discount d1

= 10%

Discount d2

= 20%

Price after discount d1

= MP × [ (100 − d1%)

/ 100 ]

= 7500 × [ (100 − 10) / 100 ] =

7500 × 90/100 = 6750

Price after second discount d2 = Discount price × [ (100 − d2

%) / 100 ]

= 6750 × [ (100 − 20) / 100 ]

= ₹ 5400

Objective

Type Questions

11. A fruit vendor sells fruits for ₹200

gaining ₹40. His gain percentage is

(A)20%

(B) 22%

(C) 25%

(D) 16 2/3

%

[Answer: (C) 25%]

Solution:

Selling price = ₹ 200

Gain = 40

∴ CP = Selling price − gain = 200 – 40 = 160

Gain % = [Gain / CP] × 100 = [40 / 160] × 100 = 25%

12. By selling a flower pot for ₹528,

a woman gains 20%. At what price should she sell it to gain 25%?

(A) ₹500

(B) ₹550

(C) ₹553

(D) ₹573

[Answer: (B) ₹ 550]

Solution:

Solution 2:

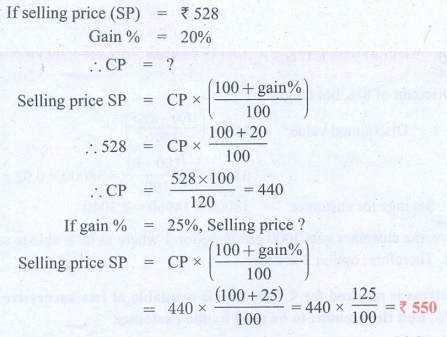

If selling price (SP) = ₹

528

Gain % = 20%

∴ CP = ?

Selling price SP = CP × [ (100

+ gain %) / 100 ]

∴ 528 = CP × [ (100 + 20) / 100 ]

∴ CP = [528 × 100] / 120 = 440

If gain % = 25%, Selling

price?

Selling price SP = CP × [ (100

+ gain%) / 100 ]

= 440 × [ (100 + 25) / 100 ] =

440 × [125 / 100] = ₹ 550

13. A man buys an article for ₹150 and

makes overhead expenses which are 12% of the cost price. At what price must he sell

it to gain 5%?

(A) ₹180

(B) ₹168

(C) ₹176.40

(D) ₹88.20

[Answer: (C) 176.40]

Solution:

Cost price of article = ₹ 150

Over head expenses = 12% of cost price

= (12 / 100) × 150 = ₹ 18

∴ Effective cost of article = 150 + 18 = ₹ 168

Now, to gain 5%, he has to sell at

SP = CP × [ (100 + gain%) / 100]

= 168 × [ (100 + 5) / 100] = 168 × 1.05 = 176.40

14. What is the marked price of a hat

which is bought for ₹210 at 16% discount?

(A) ₹243

(B) ₹176

(C) ₹230

(D) ₹250

[Answer: (D) ₹ 250]

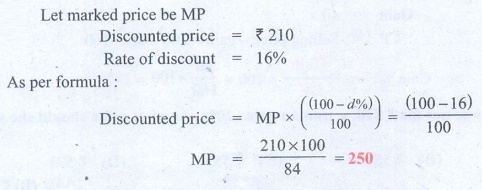

Solution:

Solution 2:

Let marked price be MP

Discounted price = ₹ 210

Rate of discount = 16%

As per formula :

Discounted price = MP × [ (100 – d%) / 100 ] = (100 – 16) / 100

MP = [210 × 100] / 84 = 250

15. The single discount in % which is

equivalent to two successive discounts of 20% and 25% is

(A) 40%

(B) 45%

(C) 5%

(D) 22.5%

[Answer: (A) 40%]

Solution:

Solution 2:

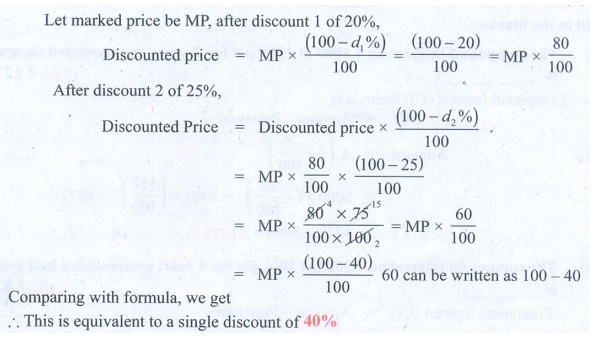

Let marked price be MP, after discount 1 of 20%,

Discounted price = MP × [ (100 – d1%) / 100 ]

= [100 – 20] / 100 = MP × [80/100]

After discount 2 of 25%,

Discounted price = Discounted price × [ (100 – d2%)

/ 100 ]

= MP × 80/100 × [ (100 – 25) / 100 ]

= MP × [ (80 × 75) / (100

× 100) ] = MP × (60 / 100)

= MP × [ (100 – 40) / 100 ] 60 can be written

as 100 − 40

Comparing with formula, we get

∴ This is equivalent to a

single discount of 40%

Answer:

Exercise 4.2

1. (i) Cost price (ii)

₹7000 (iii) ₹600 (iv) 8% (v) ₹945

2. ₹902

3. ₹670

4. 50%

5. 11 (1/9) %

6. ₹1152

7. (i) x = ₹207 (ii) y = ₹12600 (iii) z = 18%

8. ₹2836

9. Discount of 8% is

better

10. ₹5400

11. (C) 25%

12. (B) 550

13. (B) 168

14. (D) ₹250

15. (A) 40%

Related Topics